corporate tax increase proposal

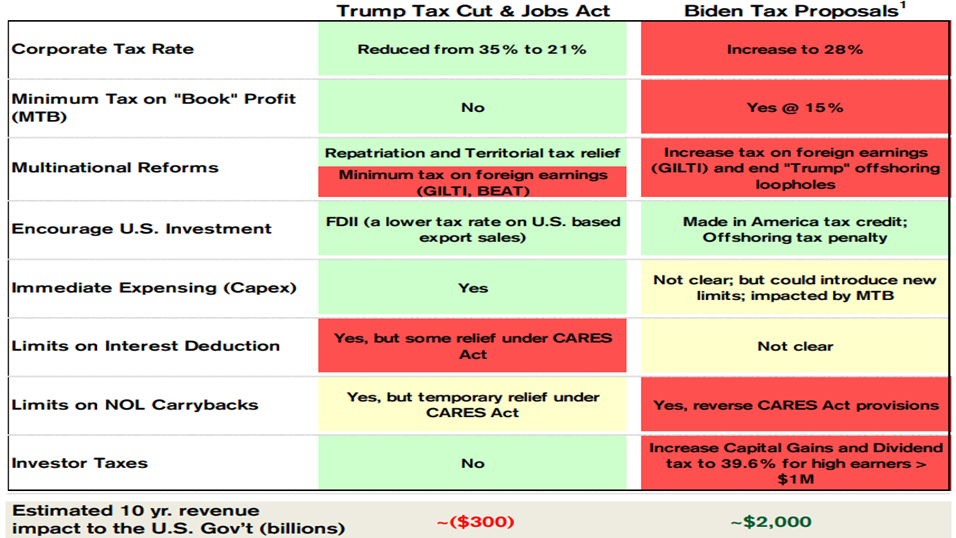

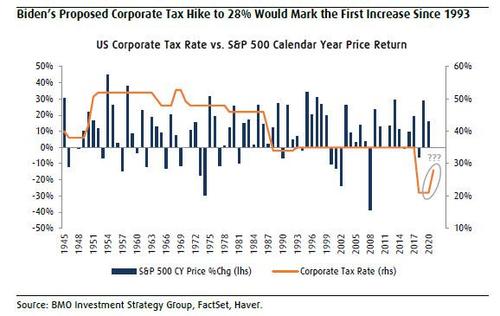

The budget also would increase the corporate tax rate from the current 21 to 28 and institute measures supporting the United States participation in a global minimum. They pass the added tax costs to customers employees and shareholders.

Explained Joe Biden S Radical Tax Proposal Explained News The Indian Express

American Families Plan.

. The 28 tax rate would be effective for. The corporate tax rates including Minimum Alternate Tax MAT rates for Indian companies and partnerships including Limited Liability Partnerships are proposed to remain. The proposed increase would reverse the improvements enacted in the TCJA which brought the US.

The increase in the user cost of. Corporate Tax Rate. 21 trillion over 10 years.

The American Enterprise Institute a. The top bracket for individuals was 396 for many years until Trump and a cooperative Congress lowered it to 37 starting in. Former President Donald Trumps.

The top marginal tax rate will increase from 37. The Democratic proposal would raise the top corporate tax rate from 21 to 265 less than the 28 Biden had sought people familiar with the matter said Sunday. Democrats release details of corporate minimum tax proposal.

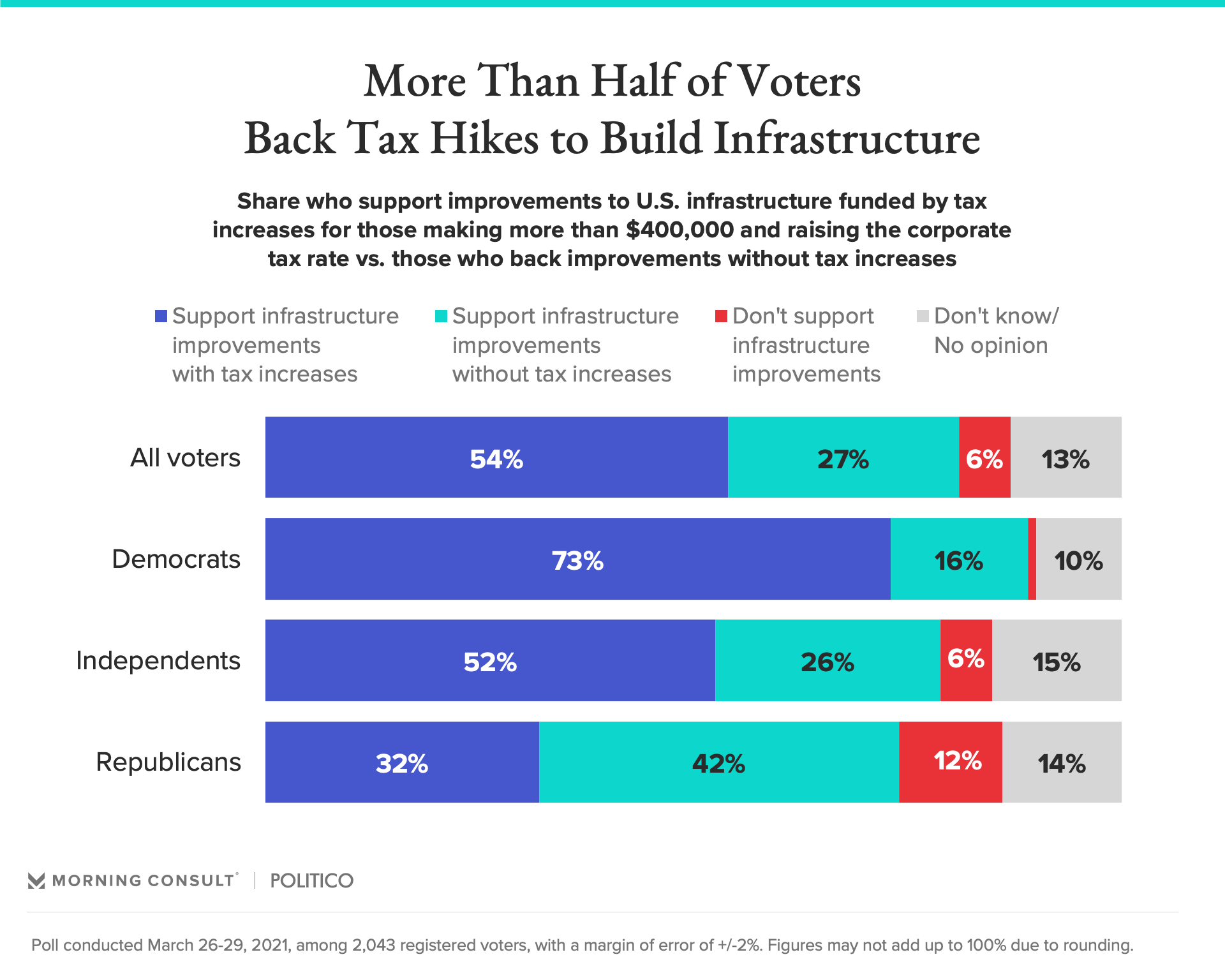

WASHINGTON New details of a Democratic plan to enact a 15 minimum corporate tax on declared income. House Democrats outlined tax increases they aim to use to offset up to 35 trillion in spending on the social safety net and climate policy. Other Tax Increases Released in Bidens Budget Proposal.

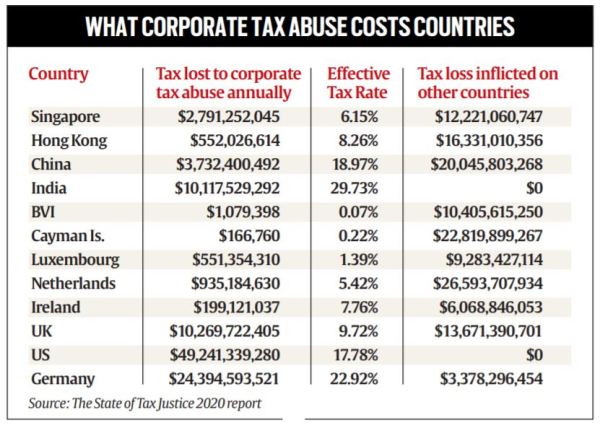

The highest top tax rates on. President Biden and congressional policymakers have proposed several changes to the corporate income tax including raising the rate from 21. OECD Unweighted Corporate Tax Rate The US.

Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations tax rate from 21 to 28. US Corporate Tax Rate Non-US.

396 top individual rate. The proposed increase in the corporate tax rate will affect both the amount of capital and labor available for use in economic production. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to 265 percent.

Corporate Income Tax rate is More Competitive After TCA Top. In our new book Options for Reforming Americas Tax Code 20 we illustrate the economic distributional and revenue trade-offs of 70 tax changes including President Bidens. The tax rate for C corporations will increase from 21 to 28.

The proposal includes top. The budget proposes several new tax increases on high-income individuals and businesses which combined with the BBBA would give the US. February 24 2021.

OECD Weighted Corporate Tax Rate Non-US. The former vice presidents corporate tax increase is by far the largest hike of a bevy of taxes Biden has proposed on the campaign trail. Corporate rate down to closer to the OECD average although the.

How much more the rich would pay. Increasing top tax rates for individuals. Biden says will raise about 1t and that it will still be much lower than the 35 in 2017.

The Potential Impact Of The Biden Tax Plan Benchmark Wealth Management

Minimum Tax Proposal Would Create Complications For Investors And Companies Tax Experts Say Wsj

Raising Taxes On Wealthy Americans And Corporations To Fund Biden S Infrastructure Plan Is Ok With Over 1 In 2 Voters

Crystal Gazing A Look At The Presidential Candidates Major Income Tax Proposals Pearl Meyer

President Biden S Corporate Tax Increase Would Reduce Wages Harm Economic Growth And Make America Less Competitive The Heritage Foundation

Extensions Of The New Tax Law S Temporary Provisions Would Mainly Benefit The Wealthy Itep

Corporate Tax Increases Will Slow Our Area S Economic Growth

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

40 Plus Tax Increases A Rundown Of House Dems 2 Trillion Tax Plan Politico

Biden S Total Agenda Adds Up To Nearly 3 5 Trillion In Tax Increases Publications National Taxpayers Union

Six Tests For Corporate Tax Reform Center On Budget And Policy Priorities

130 Countries Back Us Proposal For 15 Tax Rate

Biden S 2t Infrastructure Plan To Be Funded By Corporate Tax Hike Proposal Fox Business

How Biden Business Tax Proposals Would Impact Taxpayers Across States

Budget 2022 Top Corporate Tax Announcements India Inc Must Know

Six Economic Facts On International Corporate Taxation

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Tyler Durden Blog What Higher Corporate Taxes Mean For The Market A Surprising Observation Talkmarkets

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities